This guide, including the FAQs below, was developed to assist you in choosing the right South Carolina health insurance plan for you and your family. The plans available through South Carolina’s ACA Marketplace may be a good choice for you, and we’re here to help you understand the Marketplace and the available financial assistance.

South Carolina uses the federally run health insurance exchange/Marketplace, at HealthCare.gov , for residents to purchase ACA Marketplace plans. The Marketplace provides access to health insurance products from six private insurers, 1 with insurer participation that varies from one area of the state to another. 2

Five of the six insurers plan to continue to offer Marketplace coverage in 2025, and four of those five have proposed average rate decreases 3 (details below).

Depending on your income and other circumstances, you may qualify for financial help to lower your South Carolina Marketplace plan’s monthly insurance premium (the amount you pay to enroll in the coverage) and possibly also your out-of-pocket expenses .

Hoping to improve your smile? Dental insurance may be a smart addition to your health coverage. Our guide explores dental coverage options in South Carolina.

Learn about South Carolina's Medicaid expansion, the state’s Medicaid enrollment and Medicaid eligibility.

Use our guide to learn about Medicare, Medicare Advantage, and Medigap coverage available in South Carolina as well as the state’s Medicare supplement (Medigap) regulations.

Short-term health plans provide temporary health insurance for consumers who may find themselves without comprehensive coverage. Learn more about short-term plan availability in South Carolina.

To qualify for health coverage through the South Carolina Health Insurance Marketplace, you must: 4

Eligibility for financial assistance (premium subsidies and cost-sharing reductions) depends on your household income. In addition, to qualify for financial assistance with your Marketplace plan you must:

The open enrollment period for individual/family health coverage runs from November 1 to January 15 in South Carolina. 7

If you need your coverage to start on January 1, you must submit your application by December 15. If you apply between December 16 and January 15, your coverage will begin on February 1. 4

Outside of open enrollment, a special enrollment period (generally triggered by a specific qualifying life event ) is necessary to enroll or make changes to your coverage.

If you have questions about open enrollment, you can learn more in our comprehensive guide to open enrollment . We also have a comprehensive guide to special enrollment periods .

To enroll in an ACA Marketplace plan in South Carolina, you can:

South Carolina uses the federally run exchange for individual market plans, so residents who buy their own health insurance enroll through HealthCare.gov.

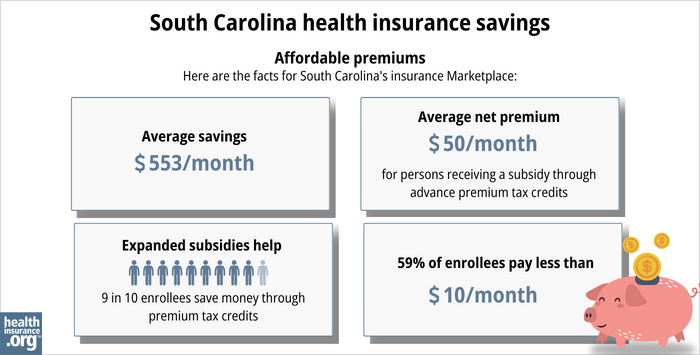

In the South Carolina Marketplace as of early 2024, 95% of enrollees were receiving premium subsidies, amounting to an average savings of $552/month. After the subsidies (premium tax credits) were applied, the average enrollee’s monthly cost was about $63/month (including those who paid full price). 9

(Note that the numbers above are based on effectuated enrollment as of early 2024. The chart below shows different metrics and reflects data across all enrollments submitted during the open enrollment period for 2024 coverage.)

The Affordable Care Act also ensures that people with household incomes up to 250% of the poverty level can enroll in Silver-level plans that have reduced out-of-pocket costs (i.e. lower out-of-pocket costs than Silver plans available to people with higher incomes). 10

Between the premium subsidies and cost-sharing reductions, you may find that a plan obtained through the South Carolina Health Insurance Marketplace will provide you with the best overall value.

South Carolina has not yet implemented the ACA’s expansion of Medicaid, so there is still a coverage gap in the state: Childless, non-disabled adults with income below the poverty level are not eligible for Medicaid (due to the lack of Medicaid expansion) and are also not eligible for Marketplace subsidies (because the ACA called for them to have Medicaid, which South Carolina has not implemented).

An estimated 76,000 low-income adults are in the coverage gap in South Carolina, ineligible for any financial assistance with their health coverage. 12

There are six insurers offering health plans through the South Carolina exchange for 2024 coverage . 1 This includes one newcomer, as UnitedHealthcare joined the South Carolina Health Insurance Marketplace for 2024: 13

Five of the six insurers plan to offer Marketplace plans for 2025, 3 but Cigna will not. People enrolled in Cigna plans in 2024 will need to select a new plan from a different insurer during the open enrollment period that begins November 1, 2o24. 14

Marketplace insurers’ coverage areas vary, but in nearly all of South Carolina’s counties, at least three insurers are offering health plans through the Marketplace for 2024. 2

The following average premium changes have been proposed for 2025 by the insurance companies that offer plans through the South Carolina Health Insurance Marketplace (rate proposals are under review by state regulators and will be finalized before open enrollment begins in November 2024):

For perspective, here’s an overview of how weighted average full-price (pre-subsidy) individual/family premiums have changed in South Carolina over time:

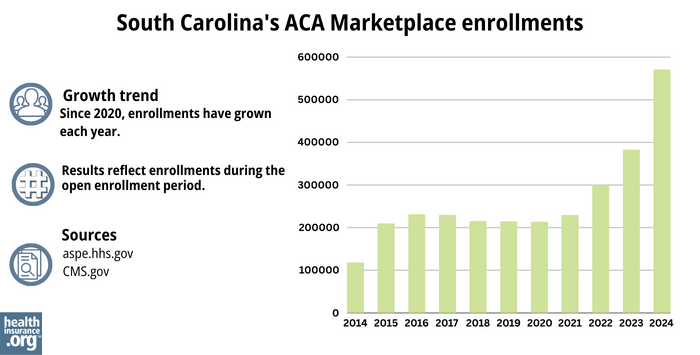

In the South Carolina marketplace, a record high 571,175 people enrolled in private plans during the open enrollment period for 2024 coverage. 24

The surge in enrollment in recent years was due in large part to the American Rescue Plan (ARP) which made the ACA’s premium subsidies more substantial and more widely available. 25 These premium subsidy enhancement provisions have been extended through 2025 by the Inflation Reduction Act.

The enrollment spike in 2024 was also driven by the “unwinding” of the pandemic-era Medicaid continuous coverage rule, when Medicaid disenrollments resumed after a three-year pause during the pandemic. CMS reported that by April 2024, more than 169,000 South Carolina residents had transitioned from Medicaid to a Marketplace plan during the unwinding process. 26

Source: 2014, 27 2015, 28 2016, 29 2017, 30 2018, 31 2019, 32 2020, 33 2021, 34 2022, 35 2023, 25 2024 36

State Exchange Profile: South Carolina

The Henry J. Kaiser Family Foundation overview of South Carolina’s progress toward creating a state health insurance exchange.

South Carolina Consumer Assistance Program

Assists people insured by private health plans, Medicaid, or other plans in resolving problems pertaining to their health coverage; assists uninsured residents with access to care.

(800) 768-3467 / [email protected]

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.